sprintax

Sprintax is the only online solution for nonresident federal tax e-filing and state tax return preparation.

Every nonresident in the US must file tax documents with the IRS.

If you were physically in the US in J status anytime between January 1 - December 31 of the tax year you're obligated to send at least one form, Form 8843, to the US tax agency IRS (Internal Revenue Service), even if you had no income.

If a nonresident J participant earns any US income, they will need to file a federal tax return with the IRS by law.

By using Sprintax Returns, you can guarantee that you are 100% US tax compliant. We will prepare every document that you need and ensure that you don’t pay any more tax than you need to.

April 15th 2024 is the tax filing deadline day for residents and non-residents who earned US income to file Federal tax returns for 2023.

Sprintax was created specifically for international students, scholars, teachers, researchers and professionals in the US on F, J, H, L, M and Q visas to make tax prep easy and ensure they are fully compliant with the IRS tax rules.

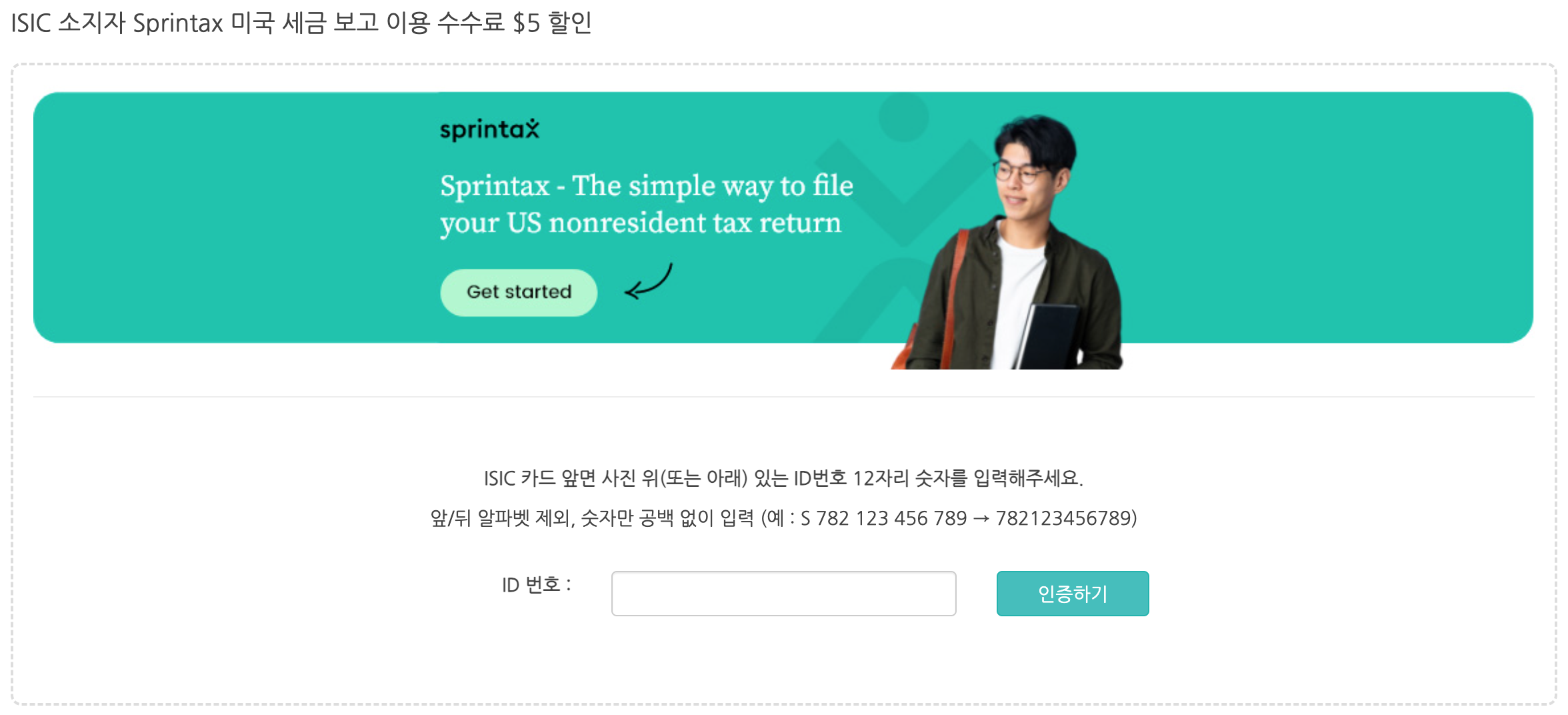

① Go to ‘Get Discount Online.’ Verify your ISIC card and check the discount code. You will be redirected to ISIC member exclusive offer page.

② Gather the documents you may need for Sprintax.

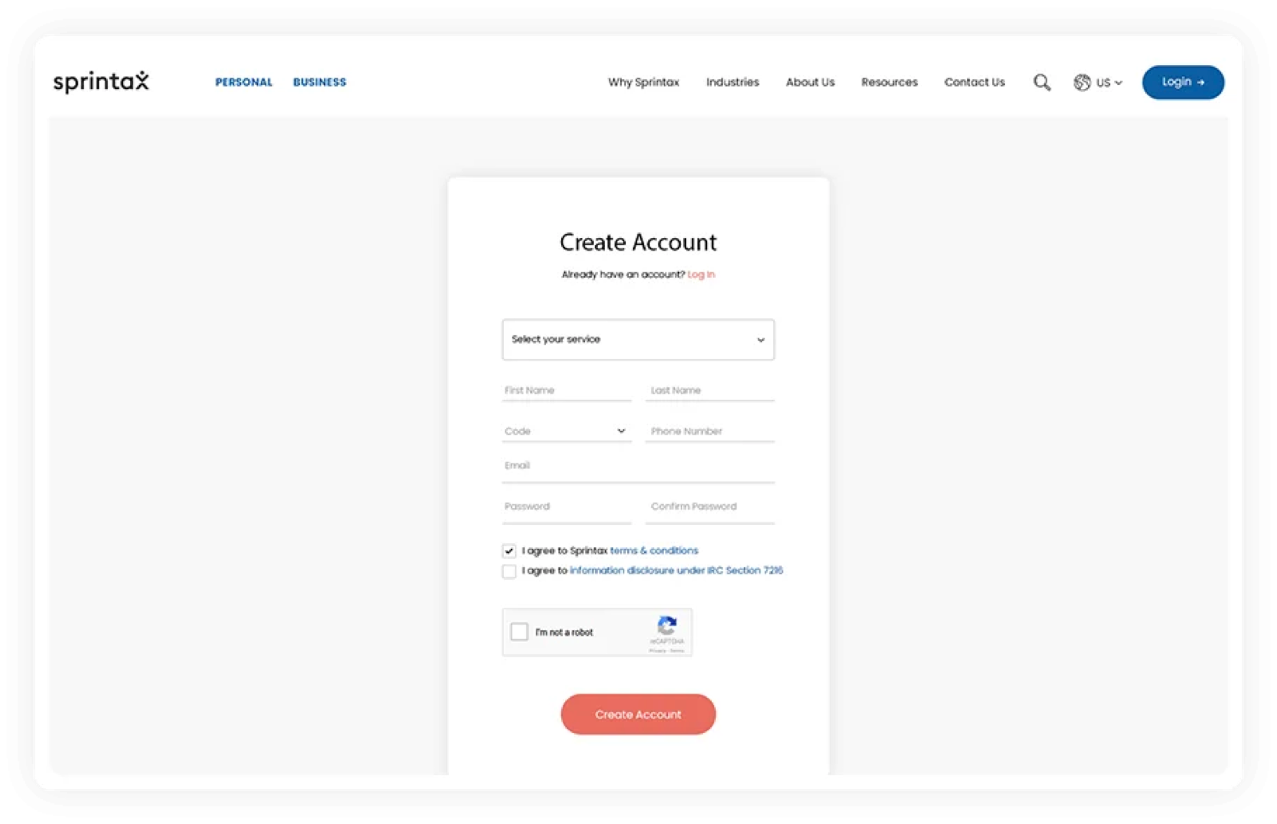

③ Create a Sprintax Account

You can create a user account by visiting the Sprintax website and creating a UserID and password or if you have an existing account on Sprintax you can log in using your existing credentials.

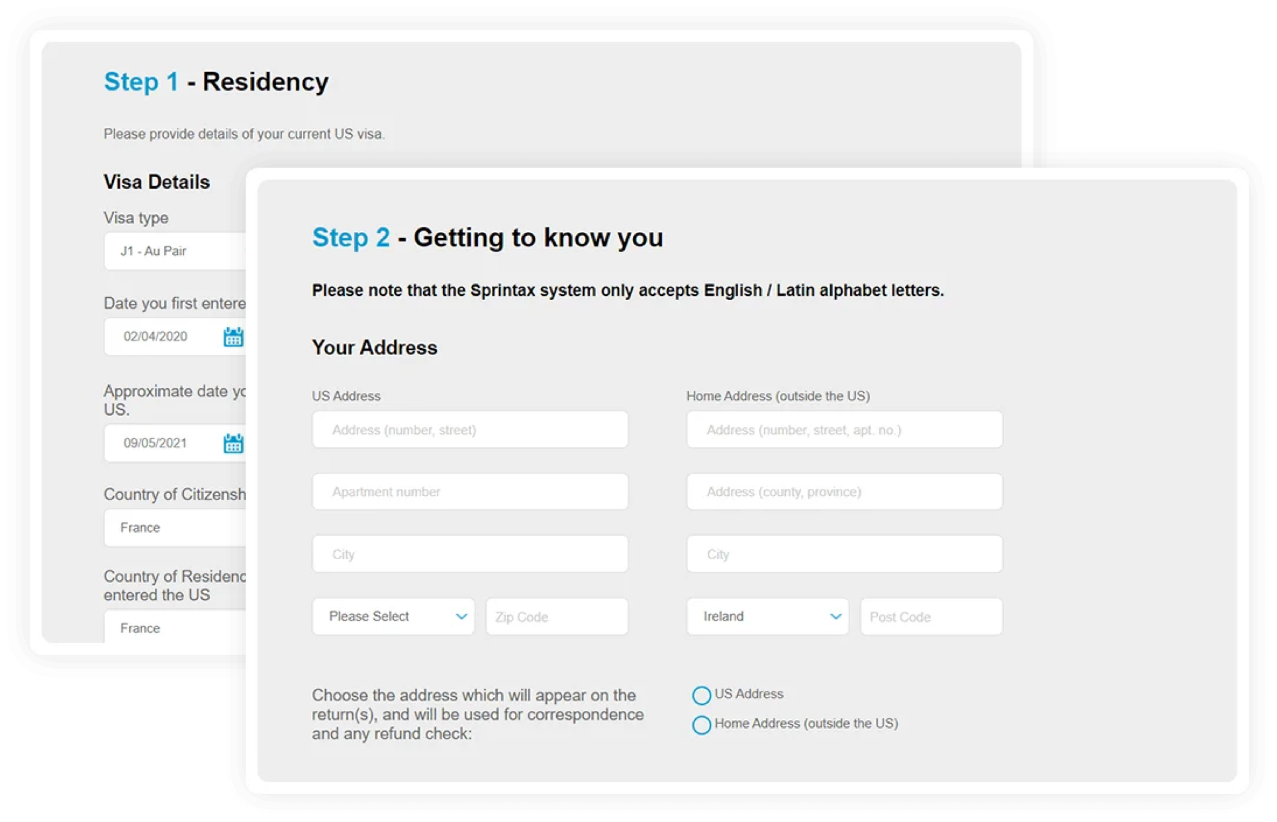

④ Answer some easy questions about your time in US. (Residency status, personal information, income, expenses, college, state tax, etc.) Sprintax applies every tax deduction and treaty benefit you are entitled to, saving you money on your tax bill.

⑤ (With US income only) If required, complete your state tax return.

After you finish your federal return, Sprintax will inform you if you need to complete a state tax return. If so, they will give you the option to use Sprintax for an individual fee. However, it is your choice to use them or to do the state tax return on your own.

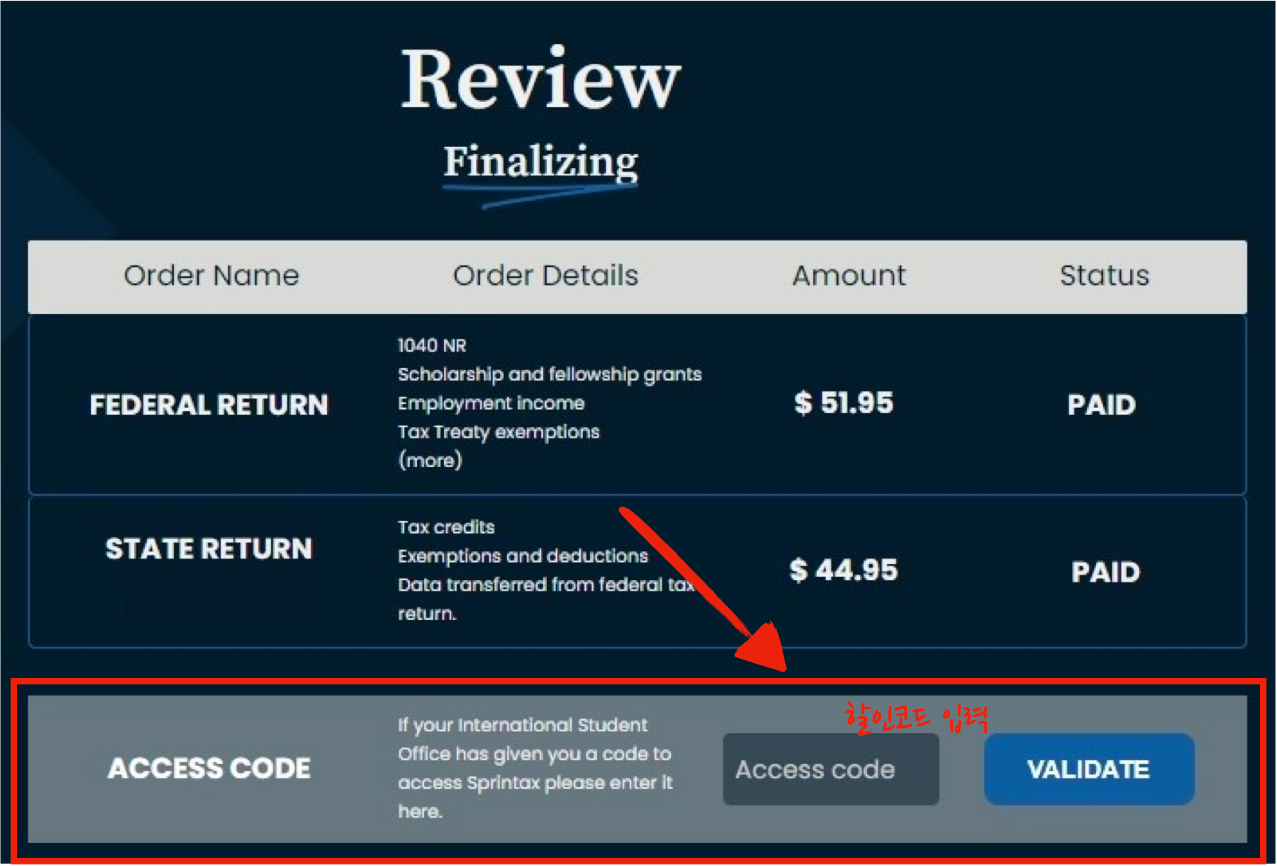

⑥ At Review, you can check how much you owe and you need to pay.

⑦ Complete the payment for Sprintax fees. Enter the discount code in the box on the ‘Review your order’ page.

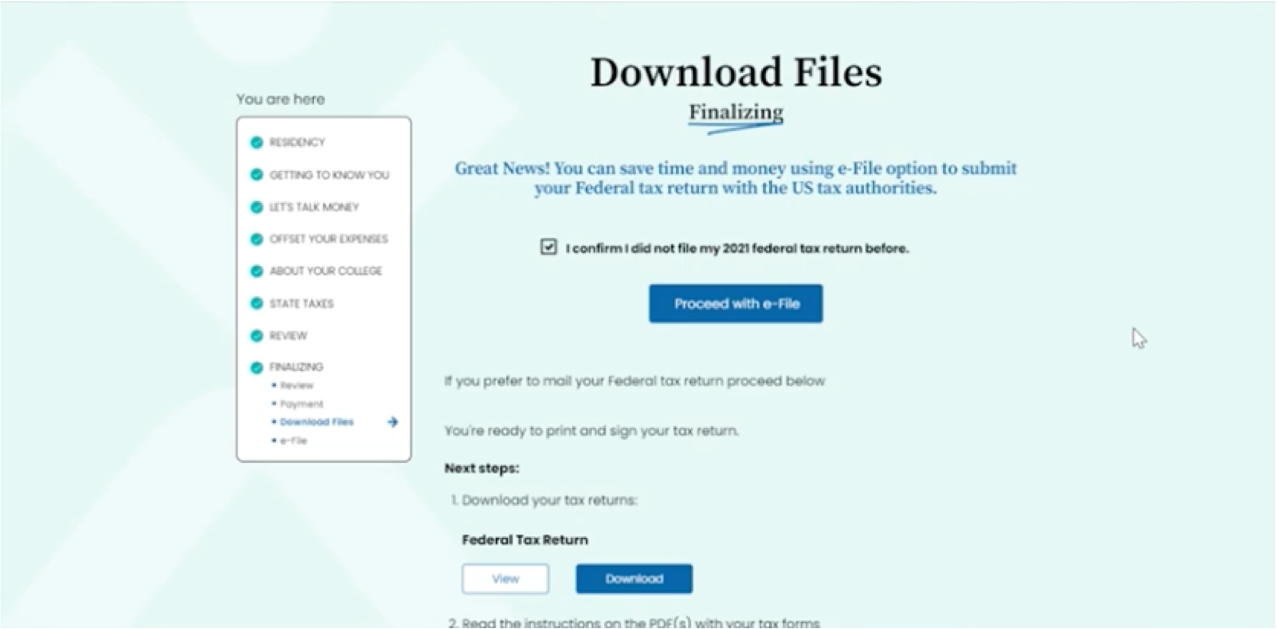

⑧ Sprintax prepares your completed tax forms you need to file.

⑨ Filing: Mail your completed federal and/or state forms to IRS and/or state tax authorities.

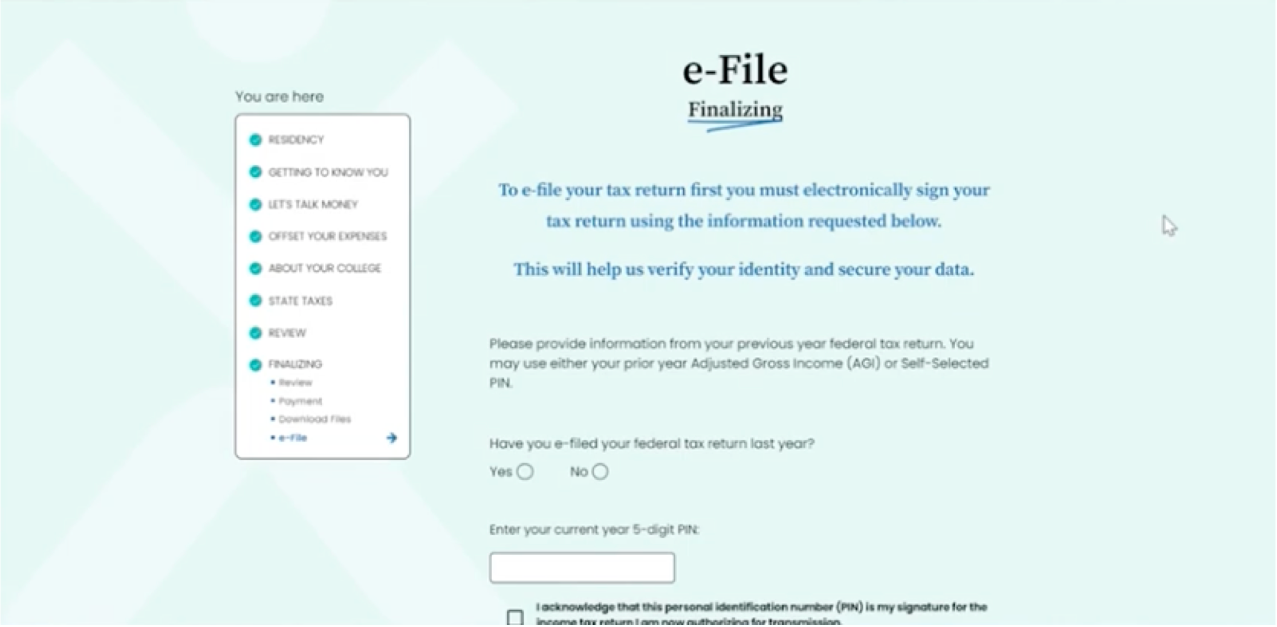

This filing season you may be able to e-file your Federal tax return directly to the IRS through Sprintax if you are eligible to do so. You will still need to print, sign and mail your state tax return if applicable.

You can learn more about your US tax obligation in this short J1 tax video from Sprintax.

You can read more about your US tax obligations here.

You are requested to login first to continue reffering.